-

U.S. Global Investors Announces Fourth Straight Quarter of AUM Growth to $4.6 Billion, with Revenues Expanding 23% QoQ and 595% YoY

Источник: Nasdaq GlobeNewswire / 10 май 2021 06:00:00 America/Chicago

SAN ANTONIO, May 10, 2021 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a boutique registered investment advisory firm with longstanding experience in global markets and specialized sectors from gold to crypto asset classes, today is pleased to report financial results for the quarter ended March 31, 2021.

Total operating revenues were $6.4 million, an increase of approximately 23% quarter-over-quarter (QoQ) and 595% year-over-year (YoY). Net income was $14.2 million, or $0.94 per share, compared to a net loss of $1.6 million, or $0.11 per share, a year earlier. Assets under management (AUM) surged to an average of $4.0 billion, up over 35% QoQ and 630% YoY. Total AUM ended the quarter at $4.6 billion, compared to $655.1 million as of March 31, 2020, an increase of about $4.0 billion, or more than 590%. Operating margin expanded to 53%, compared to an operating loss during the same period last year.

JETS Continued to Attract Inflows as Vaccine Rollout Accelerated

Inflows into the U.S. Global Jets ETF (JETS) kept pace during the quarter ended March 31, 2021, as it appears investors continued to bet that vaccine distributions would help commercial air travel demand recover to pre-pandemic levels sooner rather than later.

JETS, a quant-based, smart-beta 2.0 ETF that invests in global carriers as well as aircraft manufacturers and airport services companies, attracted healthy inflows, bringing its total AUM to $4.0 billion, up 38% QoQ and more than 1,200% YoY. Trading volume during the quarter totaled about 412 million shares, an increase of about 14% QoQ and almost 735% YoY.

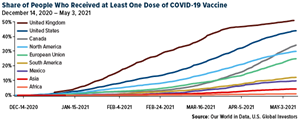

“As of the end of April, 43% of American adults had received at least one dose of the COVID-19 vaccine, while 30% were fully vaccinated, according to the Centers for Disease Control and Prevention (CDC). This is incredibly positive news for the commercial airline industry, especially when coupled with new CDC guidance saying fully vaccinated people can now travel at low risk to themselves,” comments Company CEO and Chief Investment Officer Frank Holmes. “Domestic leisure travel is roaring back, and several carriers have already announced new routes to popular vacation destinations, many of them to become available this summer. The next leg of recovery is Europe, which is seeking to reopen its borders to vaccinated tourists this summer, followed by Asia and Latin America, which currently lag the rest of the world in terms of vaccine distribution.”

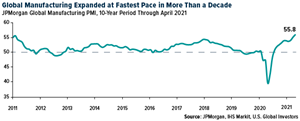

“Contributing to our bullishness is the strong rebound in global manufacturing activity. In April, the JPMorgan Global Manufacturing Purchasing Manager’s Index (PMI), a leading indicator of economic growth, registered 55.8, its best reading since April 2010. The PMIs for the U.S. and Eurozone both hit record highs of 60.5 and 62.9, respectively, suggesting the unprecedented levels of monetary and fiscal stimulus have succeeded in propping up their economies.”

Branding JETS Globally

In April, JETS became listed on the Mexican Stock Exchange (BMV), expanding the Company’s global footprint and allowing investors in Mexico to participate. The BMV is the second largest stock exchange in Latin America, with a total market capitalization of over $530 billion.

“I believe JETS will be well received by Mexican investors. Our quant approach to security selection has resulted in a number of Latin American airlines and airports joining the ETF, including Brazil’s GOL Airlines and Azul Airlines and Mexico’s Volaris and Grupo Aeroportuario del Sureste,” Mr. Holmes continues. “And our timing couldn’t have been better. Airports in Mexico serving popular travel destinations reported record traffic in March—greater, even, than traffic seen in the same month in 2019. Cancun International Airport, for instance, said arrivals finished the month at nearly 700,000, a new record for March and an increase of 5% from March 2019. Among the airports that also reported encouraging travel numbers compared to two years ago were Ciudad Juarez, Hermosillo, La Paz and Mochis.”

The Company receives a unitary management fee of 0.60% of average net assets in JETS and the Company’s other ETF, the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), and it has agreed to bear all expenses of the ETFs. The management fee is the same as the ETFs’ gross expense ratio.

Base management fees, which make up part of the company’s advisory fees, increased $5.2 million during the quarter ended March 2021 compared to the same quarter last year, due mainly to an increase in JETS’ average AUM.

Redeploying Capital Back into HIVE Blockchain Technologies, the Company’s Exposure to the Crypto Boom

During the three months ended March 31, 2021, the Company purchased convertible securities of HIVE Blockchain Technologies Ltd. (“HIVE”), a company that is headquartered and traded in Canada with cryptocurrency mining facilities in Iceland, Sweden and Canada. The convertible securities are comprised of 8.0% interest-bearing unsecured convertible debentures, with a principal amount of $14.3 million, at March 31, 2021, maturing in January 2026, and 5 million common share purchase warrants in the capital of HIVE. The principal amount of each debenture is convertible into common shares in the capital of HIVE at a conversion rate of $2.34. Each whole warrant, expiring in January 2024, entitles the Company to acquire one common share at a price of CAD$3.00. At March 31, the investments were valued at approximately $29.1 million at March 31, 2021. Converting the debentures and warrants into HIVE shares would result in the Company acquiring approximately 11 million shares of HIVE, which is approximately 0.7 of a share of HIVE for every one share of GROW.

“By repositioning our investment in HIVE, we seek to continue participating in the crypto-mining ecosystem while lowering the volatility of our investment portfolio,” Mr. Holmes explains. “Two years ago, a change was made to how we record unrealized gains and losses of certain corporate investments, such that our equity position in HIVE often swung our net income dramatically quarter-to-quarter. Obviously debt securities such as convertible debentures come with their own risks, but historically they’ve been less volatile than stocks.

“It’s important for investors and traders to be aware that Bitcoin and Ethereum remain extremely volatile, which is reflected in HIVE’s stock price since it mines both coins. HIVE was the most liquid stock on the combined TSX Venture Exchange (TSX.V) and Canadian Alternative Trading Systems (ATS) in 2020, and yet it’s still more volatile than a highly disruptive mega-cap stock like Tesla. HIVE maintains a ‘HODL’ strategy, meaning it holds the newly-minted coins it mines in the hopes of realizing higher returns, rather than immediately selling them.”

Standard Deviation for One-Year Period, as of March 31, 2021 One Day 10 Day Gold Bullion ±1% ±3% S&P 500 ±2% ±5% Gold Stocks ±3% ±8% Bitcoin ±4% ±16% Tesla ±5% ±18% Ethereum ±6% ±21% Mr. Holmes serves on the board as non-executive chairman of HIVE and held shares and options at March 31, 2021. Effective August 31, 2018, Mr. Holmes was named Interim Executive Chairman of HIVE while a search for a new CEO is undertaken.

Adequate Liquidity and Capital Resources

As of March 31, 2021, the Company had net working capital of approximately $14.1 million. With approximately $9.5 million in cash and cash equivalents and $41.4 million in available-for-sale debt and equity securities at fair value, the Company has adequate liquidity to meet its current obligations.

Share Repurchase Program

The Company has a share repurchase program, approved by the Board of Directors, authorizing it to annually purchase up to $2.75 million of its outstanding common shares on the open market through December 31, 2021. The repurchase program has been in place since December 2012. For the three months ended March 31, 2021, the Company repurchased 19,900 class A shares using cash of $127,000. The plan may be suspended or discontinued at any time.

GROW Dividends Increased

As of March 31, 2021, the Board has authorized a monthly dividend of $0.0050 per share through June 2021, at which time it will be considered for continuation by the Board. Payment of cash dividends is within the discretion of the Company’s Board of Directors and is dependent on earnings, operations, capital requirements, general financial condition of the Company, and general business conditions. As of March 31, 2021, the total amount of cash dividends expected to be paid to class A and class C shareholders from April to June 2021 is approximately $226,000.

Earnings Webcast Information

The Company has scheduled a webcast for 7:30 a.m. Central time on Monday, May 10, 2021, to discuss the Company’s key financial results for the year. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, marketing and public relations manager. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

Three months ended 3/31/2021 3/31/2020 Operating Revenues $6,355 $914 Operating Expenses 3,003 1,893 Operating Income (Loss) 3,352 (979) Total Other Income (Loss) 15,474 (503) Income (Loss) from Continuing Operations Before Income Taxes 18,826 (1,482) Income Tax Expense 4,602 75 Net Income (Loss) from Continuing Operations 14,224 (1,557) Loss from Discontinued Operations - (85) Net Income (Loss) 14,224 (1,642) Less: Net Loss Attributable to Non-Controlling Interest - (30) Net Income (Loss) Attributable to U.S. Global Investors, Inc. $14,224 $(1,612) Net income (loss) per share (basic and diluted) $0.94 ($0.11) Avg. common shares outstanding (basic) 15,061,818 15,121,950 Avg. common shares outstanding (diluted) 15,062,988 15,121,950 Avg. assets under management from continuing operations (millions) $3,993.8 $534.9

About U.S. Global Investors, Inc.The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides money management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com. Read it carefully before investing. U.S. Global mutual funds are distributed by Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

JETS and GOAU are distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS and GOAU. Foreside Fund Services, LLC and Quasar Distributors, LLC are affiliated.

Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Companies in the consumer discretionary sector are subject to risks associated with fluctuations in the performance of domestic and international economies, interest rate changes, increased competition and consumer confidence. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors. The outbreak of the COVID-19 pandemic and the resulting actions to control or slow the spread has had a significant detrimental effect on the global and domestic economies, financial markets and industries, including airlines. U.S. Global Investors continues to monitor the impact of COVID-19, but it is too early to determine the full impact this virus may have on commercial aviation. Should this emerging macro-economic risk continue for an extended period, there could be an adverse material financial impact to the U.S. Global Jets ETF.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

A smart-beta ETF is a type of exchange-traded fund that uses a rules-based system for selecting investments to be included in the fund. The JPMorgan Global Manufacturing PMI gives an overview of the global manufacturing sector. It is based on monthly surveys of over 10,000 purchasing executives from 32 of the world's leading economies, including the U.S., Japan, Germany, France and China which together account for an estimated 89 percent of global manufacturing output. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the press release were held by one or more accounts managed by U.S. Global Investors as of3/31/2021: GOL Linhas Aereas Inteligentes SA; Azul SA; Grupo Aeroportuario Centro Norte, S.A.B. de C.V.; American Airlines Group Inc.; Delta Air Lines Inc.; Tesla Inc.

Contact:

Holly Schoenfeldt

Marketing & Public Relations Manager

210.308.1268

hschoenfeldt@usfunds.comPhotos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/60997bc9-73f0-4670-929d-bc211a07f08d

https://www.globenewswire.com/NewsRoom/AttachmentNg/a9252a7d-da33-4fe4-88a5-ed8aa313e1ce